1 Market-Beating ETF That Doesn’t Have Nvidia, Microsoft, or Apple Among Its Top 3 Holdings

Many top exchange-traded funds (ETFs) that have been outperforming the S&P 500 in recent years all have a common theme, which is that their top three holdings usually include at least one of the following tech stocks: Nvidia, Microsoft, or Apple.

There’s nothing wrong with those stocks, as they give investors exposure to some fantastic companies, but their high valuations could make investors hesitant about investing in funds that are so dependent on them. If there’s a correction in the market, particularly in tech, those three stocks may be particularly vulnerable.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

For investors who want to focus on growth stocks but don’t want heavy exposure to those three tech giants, one ETF you may want to consider is American Century U.S. Quality Growth ETF (NYSEMKT: QGRO). Here’s a closer look at the fund, and why it could make for a fantastic long-term investment.

The fund offers broad exposure to top growth stocks

The American Century U.S. Quality Growth ETF holds 200 stocks in its portfolio, with a weighted average market cap of around $407 billion. The fund’s top three holdings are Netflix, Booking Holdings, and TJX Companies. And none of those three stocks individually account for even 4% of the ETF’s total weight. Its top 10 stocks, in total, represent a fairly modest 29% of American Century’s total portfolio. That’s great diversification for investors as it reduces the risk that one or even a few poor-performing stocks could sink the fund.

Tech stocks still play an important role in its performance, however, making up 37% of the ETF’s holdings. But without heavy exposure to any individual stock, that can make American Century a much more attractive option for growth investors. You’re still getting exposure to many great tech stocks, but that diversification can help reduce your overall risk. Nvidia, Microsoft, and Apple are all within the fund’s portfolio but together, they represent just 3.8% of its total weight.

Other sectors that are key components of the ETF include consumer discretionary, which accounts for 16% of its holdings, followed by industrials at 11%, and communication services at 10% — the last one to be in the double digits.

Strong returns and a modest fee make it a good option for investors

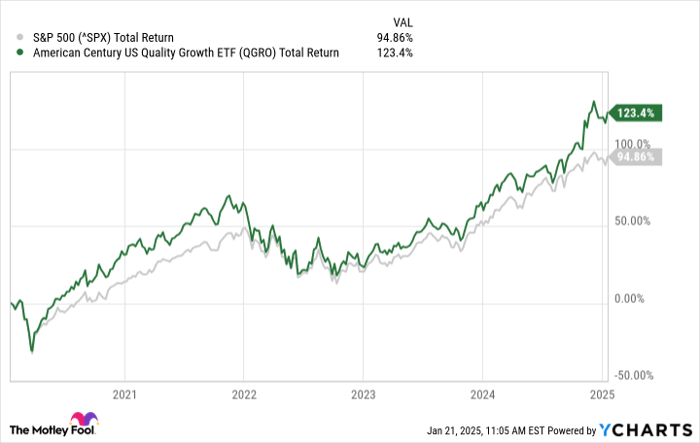

The American Century ETF has only been around since 2018 and so it doesn’t have a long track record. But over the past five years, it has easily outperformed the S&P 500, without having to rely heavily on a select few tech stocks. That’s an impressive performance and speaks to the quality of the growth stocks it contains in its portfolio.

The fund has an expense ratio of 0.29%, which is a bit higher than other ETFs, but it’s still fairly low overall. And I believe it’s justifiable given the more balanced growth option it provides investors.

Can this fund continue to outperform the market?

As well as the fund has performed of late, American Century can potentially remain a market-beating ETF in the years ahead due to its diversification. Its safer mix of growth stocks can position investors to benefit from the market’s long-term gains without having to worry about a few stocks that could derail its performance.

For investors who want a fund that isn’t as dependent on the three most valuable stocks in the world, this ETF can be a great option to add to your portfolio right now and hang on to for the long haul.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $369,816!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,191!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $527,206!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 21, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Booking Holdings, Microsoft, Netflix, Nvidia, and TJX Companies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.