Is Dell Technologies a Good Under-the-Radar AI Stock?

When you hear Dell Technologies (NYSE: DELL), you probably think of the laptop you use at work. While that’s a fair assessment because that’s likely the most common interaction you have with the company’s products, Dell is also a massive player in the artificial intelligence (AI) space.

Its server division is growing rapidly, and benefits from helping build out all the computing power companies need to develop and deploy AI models. This makes it a potential under-the-radar AI stock, but is it worth investing in?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Dell’s two divisions are performing at different levels

As mentioned, Dell can split its company into two parts: its PC division, which it calls Client Solutions Group (CSG); and its server division, Infrastructure Solutions Group (ISG). While both divisions provide their customers with computing power, the growth in these two couldn’t be more different.

CSG has practically no growth, and its revenue was $12.1 billion during Q3 FY 2025 (ending Nov. 1), which was down 1% year over year. However, commercial client revenue within this segment was up 3% to $10.1 billion, which shows that Dell has an issue with consumers, not with the business-class customers it sells to. Regardless, this division likely doesn’t have a chance at growing at a superfast pace, as most people and businesses have laptops and PCs for everyone. The only thing that will move the needle for this segment is a computer refresh cycle, but that boost won’t last forever and will eventually fall back to a mundane growth rate again.

On the flip side, Dell’s ISG group is producing rapid growth, with revenue up 34% year over year to $11.4 billion in Q3. Within this division, networking revenue rose 58% year over year to $7.4 billion. There’s massive demand for servers in the AI computing realm, and Dell is significantly benefiting from that.

While AI usage has dramatically increased over the past few years, we’re far from reaching the limit of how integrated it will become in our daily lives. As a result, this growth catalyst should continue for Dell for some time.

Overall, Dell’s revenue rose 10%, and earnings per share (EPS) increased 16% year over year. There were many ups and downs to get to that middle number, but the result is a stock that looks like it can beat the market if its growth keeps up.

But is the stock priced right?

Dell’s stock price looks cheap but for a good reason

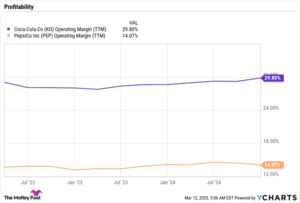

Because Dell is a fully mature company, using its price-to-earnings (P/E) ratio is a great way to value the company. At 18 times trailing earnings and 11 times forward earnings, Dell is a very cheap stock compared to the rest of the market.

DELL PE Ratio data by YCharts

For example, stocks in the broader S&P 500 (SNPINDEX: ^GSPC) trade at average ratios of 25.5 times trailing earnings and 22.3 times forward earnings. This shows how much cheaper Dell is, which might lead investors to scoop up some shares.

While I don’t think it’s a bad idea, investors must remember that PCs and servers have become a commodity. There’s no real differentiation between Dell’s products and competitors, so it’s not hard for a client to switch to a different provider. This is part of why Dell’s stock is so cheap, as it doesn’t have a key characteristic to separate it from the competition.

With that in mind, I’ll probably pass on Dell’s stock, as its five-year average trailing P/E ratio is 13.8, which isn’t far from where it is now. Dell stock may rise a bit more in 2025 (and even beat the market), but over the long term, there are far more attractive options that can consistently beat the market for multiple years.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $333,669!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,168!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $547,748!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.