Want Decades of Passive Income? 2 Stocks to Buy Now and Hold Forever.

Most companies don’t survive for decades, much less pay regular dividends for that long. However, some rare corporations can pull it off. These are the kinds of stocks long-term investors will often be interested in, since they must have excellent, resilient businesses to sustain dividend programs for decades. Healthcare leaders Merck (NYSE: MRK) and Abbott Laboratories (NYSE: ABT) are among the companies that have the profile of forever dividend stocks. Here’s what income-seeking investors need to know about them.

1. Merck

Merck is one of the largest pharmaceutical companies in the world. The drugmaker’s lineup is fairly deep and features the best-selling drug in the world: Cancer medicine Keytruda. Merck is also a leader in the animal health industry. It has been around for decades and has maintained a dividend program for a long time. Merck’s current annual dividend per share tops $3.24 with a forward yield of about 3.3%, compared to the S&P 500‘s average of 1.3%.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

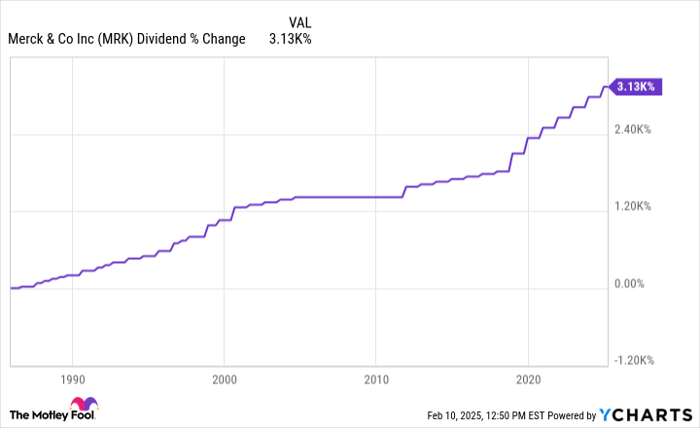

MRK Dividend data by YCharts.

Merck’s track record speaks volumes. Developing novel medicines is an expensive and risky activity. However, the company has done it regularly enough to maintain decent revenue and earnings growth, allowing it to grow its payouts over time. Some might be skeptical of Merck’s prospects from here on out.

Keytruda will face a patent cliff in 2028. Although the drugmaker has planned for that by developing a subcutaneous (SC) formulation of the medicine that will extend its patent life, SC Keytruda will face mounting competition from medicines in development, such as Summit Therapeutics‘ ivonescimab.

Thankfully, the original version of Keytruda should continue growing its sales largely unaffected through 2028, since ivonescimab is still in clinical trials, albeit late-stage ones. Beyond that, Merck is betting on its ability to identify and develop promising candidates, which has served it well over the years. The company has penned a deal to develop a potential GLP-1 weight loss therapy, HS-10535, with China-based Hansoh Pharma.

It signed a similar licensing deal with LaNova Medicines for the development of LM-299, a potential cancer medicine. LM-299 is a bispecific antibody, a class of oncology products that could grow significantly in prominence thanks to relatively recent breakthroughs in the field. Keytruda’s would-be challenger, ivonescimab, is part of this class of drugs, as is BioNTech‘s BNT327, another medicine being touted as a future Keytruda competitor.

Merck’s recent moves show that it won’t simply roll over. The company will continue creating new drugs, just as it has before. Its pipeline features several dozen programs. Here’s the bottom line: Merck is an innovator in an industry whose products and services will only attract higher demand over time, especially with an aging population. The company should perform well over the long run and maintain its dividend program.

2. Abbott Laboratories

Abbott Laboratories’ business spans several areas of the healthcare sector, including medical devices (its most important unit), nutrition, diagnostics, and pharmaceuticals. The company has dozens of products under its brands, some of which are among the leaders in their respective niches. For instance, Abbott Laboratories’ FreeStyle Libre product line is one of the most lucrative in the continuous glucose monitoring (CGM) market, which is practically a duopoly it shares with DexCom.

Abbott Laboratories’ Similac baby formula brand is well known, as are the products under its Ensure brand that provide nutritional supplements. Abbott Laboratories has maintained a strong business for years, and its dividend program is exceptional. The healthcare leader is a Dividend King with an active streak of 52 consecutive payout increases. Abbott Laboratories’ annual dividend per share and forward yield are $2.36 and 2%, respectively.

Considering its track record and long-term prospects, the company’s dividend looks pretty safe. Abbott Laboratories should benefit from many tailwinds that will boost its financial performance. Chief among them is the company’s work in diabetes care, especially its FreeStyle Libre franchise.

This suite of CGM devices helps diabetes patients keep track of their blood sugar levels better than blood glucose meters. However, despite the benefits associated with the use of CGMs, Abbott estimated that only 1% of diabetes patients worldwide use this technology.

So, there is a massive runway for growth here, and it won’t be the only one for Abbott Laboratories. Abbott should continue delivering good financial results while growing its payouts. This healthcare stock is a clear winner for those seeking long-term dividend income.

Should you invest $1,000 in Merck right now?

Before you buy stock in Merck, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Merck wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $813,868!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 7, 2025

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories, Merck, and Summit Therapeutics. The Motley Fool recommends BioNTech Se and DexCom and recommends the following options: long January 2027 $65 calls on DexCom and short January 2027 $75 calls on DexCom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.