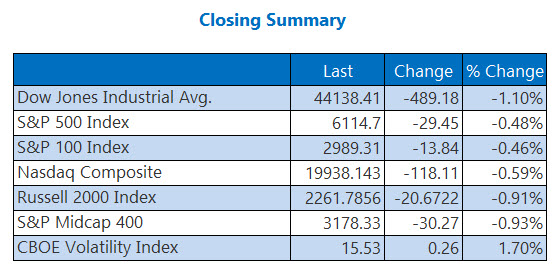

Nasdaq Snaps Winning Streak; Dow Logs Worst Day Since January

Wall Street pulled back sharply Thursday, weighed down by Walmart’s disappointing earnings report that reignited macroeconomic concerns. The Dow lost 450 points for its worst single-session drop since Jan. 10. The S&P 500 took a step back as well, retreating from back-to-back record highs, while the Nasdaq snapped a five-day win streak. Tech giant Palantir (PLTR) continued to cool off, now taking on a weekly deficit of more than 12%.

Continue reading for more on today’s market, including:

- Why options traders are eyeing this crypto stock.

- Bull signal flashing for C3.ai stock before earnings.

- Plus, another fear gauge to know; behind BABA’s bounce; and Carvana’s earnings.

5 Things to Know Today

- One Federal Reserve President is worried about stagflation. (MarketWatch)

- Israeli Prime Minister Benjamin Netanyahu vowed retaliation against Hamas after the group released the bodies of four hostages. (Reuters)

- Another fear gauge investors should monitor.

- What made Alibaba stock surge today?

- Carvana’s strong quarter overshadowed by gloomy forecast.

Gold Nabs 10th All-Time High of 2025

Oil futures inched higher for the third-straight day, after industry data signaled a rise in U.S. crude stockpiles. The most active April-dated West Texas Intermediate (WTI) crude added 15 cents, or 0.2%, to settle at $72.25 per barrel.

Gold prices climbed to yet another record high, marking the 10th all-time peak of the year. The precious metal hit $2,954.69 as demand for the safe-haven asset surged amid rising fears of a global trade war, sparked by President Donald Trump’s latest tariff threats. As of the latest reading, the February contract was up 0.7% at $2,957.50 an ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.