YieldBoost Playtika Holding To 33.5% Using Options

Shareholders of Playtika Holding Corp (Symbol: PLTK) looking to boost their income beyond the stock’s 8.6% annualized dividend yield can sell the May covered call at the $5 strike and collect the premium based on the 20 cents bid, which annualizes to an additional 24.9% rate of return against the current stock price (at Stock Options Channel we call this the YieldBoost), for a total of 33.5% annualized rate in the scenario where the stock is not called away. Any upside above $5 would be lost if the stock rises there and is called away, but PLTK shares would have to advance 7.3% from current levels for that to happen, meaning that in the scenario where the stock is called, the shareholder has earned a 11.6% return from this trading level, in addition to any dividends collected before the stock was called.

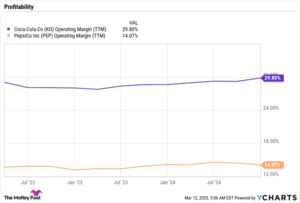

In general, dividend amounts are not always predictable and tend to follow the ups and downs of profitability at each company. In the case of Playtika Holding Corp, looking at the dividend history chart for PLTK below can help in judging whether the most recent dividend is likely to continue, and in turn whether it is a reasonable expectation to expect a 8.6% annualized dividend yield.

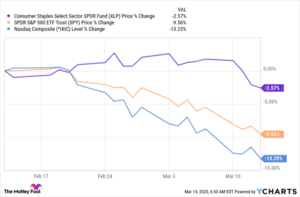

Below is a chart showing PLTK’s trailing twelve month trading history, with the $5 strike highlighted in red:

The chart above, and the stock’s historical volatility, can be a helpful guide in combination with fundamental analysis to judge whether selling the May covered call at the $5 strike gives good reward for the risk of having given away the upside beyond $5. (Do most options expire worthless? This and six other common options myths debunked). We calculate the trailing twelve month volatility for Playtika Holding Corp (considering the last 250 trading day closing values as well as today’s price of $4.66) to be 38%. For other call options contract ideas at the various different available expirations, visit the PLTK Stock Options page of StockOptionsChannel.com.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also see:

Institutional Holders of LRGG

SFHY YTD Return

IIIV YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.