Dow Settles at Lowest Level Since September

Tariffs on Canadian aluminum and steel were in focus during today’s volatile session, after President Trump announced they’d double to 50% starting tomorrow. Meanwhile, Ukraine agreed to a 30-day ceasefire plan negotiated by the U.S., should Russia also accept it.

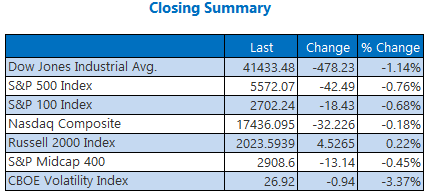

The Nasdaq pared triple-digit gains despite investors rushing to buy tech stocks on the dip, finishing modestly in the red alongside the S&P 500. The Dow, on the other hand, dropped 478 points to settle at its lowest level since September.

Continue reading for more on today’s market, including:

- Cybersecurity stock flashing historically bullish signal.

- How the VIX tends to perform after an extended bounce.

- Plus, 2 airliners making headlines; construction stock downgraded; and retailers wary of consumer sentiment.

5 Things to Know Today

- This isn’t the first time Trump placed tariffs on steel and aluminum. Here’s what happened in 2018 after tariffs of 25% on steel and 10% on aluminum. (Reuters)

- Verizon Communications (VZ) stock fell sharply after disappointing commentary regarding its current quarter. (Reuters)

- Airline stocks moving after key updates.

- KBW downgraded Lennar stock to “market perform.”

- 2 retail stocks issued profit warnings.

Oil, Gold Rise on Global Trade Tensions

Oil prices finished higher amid trade policy uncertainty, though they fell from session highs after news of Ukraine’s ceasefire. The front-month contract, April-dated Texas Intermediate (WTI) crude, added 22 cents, or 0.3%, to settle at $66.25 a barrel.

Bullion rose after the U.S. dollar index hit its lowest level since early November. U.S. gold futures rose 0.7% to $2,920.90 an ounce.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.