Got $1,000? 1 Underrated Artificial Intelligence Stock to Buy During the Nasdaq’s Latest Correction

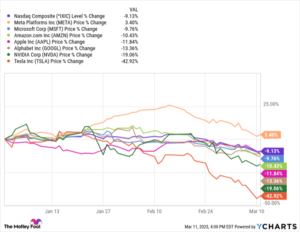

Less than three months ago, the Nasdaq Composite hit an all-time high, continuing a solid run that began two years ago. Since that mark, the index is down over 13%, including a 9% drop this year, and is in correction mode (as of March 11).

As an index heavily influenced by large tech stocks, it’s no surprise that many big-name tech stocks have followed the same fate this year. Of the “Magnificent Seven” stocks, Meta Platforms is the only one in the green so far this year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

While many tech companies dealing with artificial intelligence (AI) experienced surges over the past couple of years, that same hype (or lack thereof) has led to some significant drops alongside the Nasdaq correction.

That said, one underrated AI stock is looking increasingly appealing during this recent sell-off: Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL). If you have $1,000 to invest, now could be a good time to consider scooping up some shares for the long haul.

Alphabet is one of the key innovators in AI

While many companies have embraced and thrown resources at AI-related projects over the past couple of years, Alphabet has been at the forefront of many AI innovations. It has an AI research company called DeepMind that has focused on developing advanced AI models, machine learning algorithms, deep learning frameworks, and reinforcement learning systems.

DeepMind doesn’t get the attention of other Alphabet companies, but it has been crucial to Alphabet’s AI advancements, including the development of its AI model, Gemini. Being one of the first prominent players and having in-house AI research and development gives Alphabet a leg up on other big tech companies still building their infrastructure or relying on third-party models (like those produced by OpenAI).

In 2024, Alphabet spent $52 billion on capital expenditure and plans to spend around $75 billion this year. Given the importance of AI initiatives to its growth, it’s safe to assume a nice chunk will (or should) go toward that effort. And while spending more money doesn’t guarantee success, it shows the company’s willingness to invest aggressively in its fastest-growing segment.

Assuming Alphabet does spend $75 billion, it would be more than a 130% increase from just 2023.

GOOGL Capital Expenditures (Annual) data by YCharts

Google Cloud is gaining traction

Cloud computing is a high-growth business for many big tech companies, including Alphabet. Its Google Cloud platform trails Amazon Web Services (AWS) and Microsoft Azure in market share, but its market share has doubled in the past seven years to 12% and is some distance ahead of fourth-place Alibaba Cloud.

In the fourth quarter (Q4), Google Cloud made $12 billion in revenue, up 30% year over year. Alphabet’s CEO, Sundar Pichai, noted that the AI-powered Google Cloud platform was seeing stronger customer demand, and its financial growth underpins that.

Google advertising should be Alphabet’s bread and butter for the foreseeable future, but Google Cloud is beginning to hold more of its own weight. Of Alphabet’s $96.5 billion in revenue in Q4, Google Cloud accounted for 12%. Just five years ago, it only accounted for around 5%.

GOOGL Revenue (Quarterly) data by YCharts

In the long term, Alphabet needs to depend less on Google Search, which was 56% of its Q4 revenue. It won’t stop being Alphabet’s money maker, but having Google Cloud pick up some slack is encouraging.

Alphabet is beginning to look like a bargain

A few months ago, Alphabet’s stock was trading nearly 34 times its earnings. It wasn’t as expensive as other Magnificent Seven stocks, but it also wasn’t clearance-rack cheap.

After recent drops, Alphabet’s stock is entering bargain territory, trading at just over 20 times its earnings, much cheaper than its recent average.

GOOGL PE Ratio (Annual) data by YCharts

There’s always risk when you invest in stocks, especially high-growth tech stocks like Alphabet. However, there is much less risk buying Alphabet at current prices than just a couple of months ago.

Who knows if prices will continue to drop? But if you’re interested in investing in Alphabet, now could be a good time to begin adding shares. If you’re concerned about further drops, consider dollar-cost averaging and spreading out your investment to help offset volatility.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $315,521!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $40,476!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,070!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 14, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Alibaba Group, Apple, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Alibaba Group and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.