I didn’t realize it at the time, but I was an early adopter of Airbnb (NASDAQ: ABNB), having used the short-term rental platform often, both domestically and internationally, for more than a decade. My large family makes hotel stays complicated — many have a limit of five people per room, not to mention that kids are hard to keep quiet out of courtesy for the other hotel guests.

I usually find an Airbnb rental that accommodates my family within our budget. Kids have a blast without worrying about disturbing people in the next room. Moreover, going out to eat gets expensive with a family, but our short-term rental usually has a full kitchen so we can cook and keep costs low.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Suffice it to say that, as a customer, I’m a fan of Airbnb. And someday when life allows, I would like to be an Airbnb host as well. So, it was only natural that I would be an investor in Airbnb stock as well. The company went public in Dec. 2020, and I became an investor in early 2021.

Despite my clear enthusiasm for the brand, I haven’t invested in Airbnb since 2021. But in 2025, I just increased my position for the first time in over three years. In fact, I just increased it by 60%. Here’s why I’m suddenly acting with heightened conviction.

Airbnb stock trades at an absolute bargain price

Before I get to my main point in this section, I should probably explain why I invested in Airbnb in the first place. It’s not just because I like the platform — this is a massive, high-margin business that can stand the test of time.

For starters, Airbnb has a brand moat. There are some growing competitors, yes, but around 90% of its traffic is organic. In other words, management isn’t bleeding cash to acquire users. Travelers know the Airbnb name and seek it out without prompting.

Furthermore, the company doesn’t supply the short-term rental inventory, which would be costly. It simply provides the digital marketplace that connects travelers with hosts. And because it’s digital, its cut of the revenue (its take rate) is high-margin. The business’ gross margin was 83% through the first nine months of 2024.

When Airbnb first went public, it wasn’t profitable on a free-cash-flow basis. But management quickly shifted its focus to profitability, and free cash flow skyrocketed. With a competitive moat, a high gross margin, and fiscal discipline from management, I gladly purchased shares of Airbnb for the long haul.

There was one knock against the stock though: its valuation. On a free-cash-flow basis, it was very expensive at the time, so I gradually built up my position using a strategy called dollar-cost averaging.

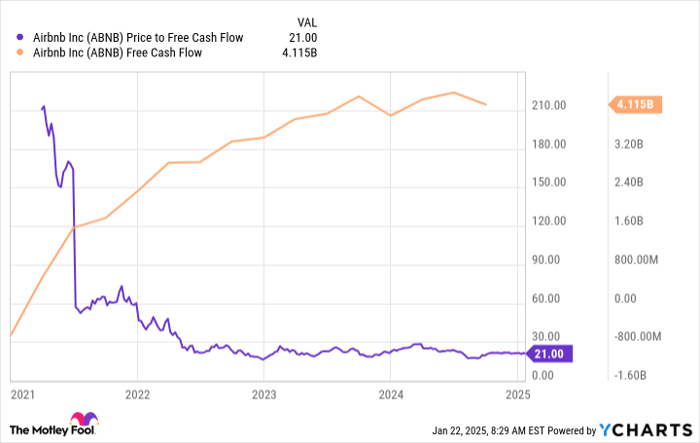

However, as the chart below shows, the stock has become a lot cheaper over the last three years.

Data by YCharts.

Trading at 21 times its free cash flow, the stock has what I’d call a modest valuation. With the S&P 500 boasting a price-to-free cash flow ratio of 31, investors are essentially betting the stock will underperform long term.

But I couldn’t disagree more with that sentiment, and I believe the stock will catch investors off-guard with substantial upside.

Airbnb is swinging for the fences

Airbnb isn’t perfect. It only had 10% year-over-year revenue growth in the third quarter of 2024. There are always cloudy skies on the regulatory horizon for short-term rentals, and competition is fierce.

However, the company is in an enviable financial position to weather a variety of potential storms. It has generated $4.1 billion in trailing-12-month free cash flow, and it has $11.3 billion in cash.

With its financial strength and its strong competitive position, management is now swinging for the fences. It referenced Amazon‘s journey from selling books online to selling everything, and now developing products for enterprise customers.

In the same way, Airbnb management intends to go far beyond what it does today. CEO Brian Chesky says that the company will launch one to two new businesses annually starting this year. The hope is that each idea could add at least $1 billion to the top line.

For just a moment, let’s assume this is possible. The company has $10.8 billion in trailing-12-month revenue. If its new business ideas are successful, the overall size of the company could double in the next five years, to say nothing of growth in the core business.

Of course, not every new idea will be successful — Amazon has had its share of failures, too. But Airbnb’s business is rock-solid, and the stock is reasonably valued, shielding shareholders from downside risk. And then, there’s the potential for much higher upside if its expansion plans go right, which makes the stock a compelling and timely opportunity.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $874,051!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 21, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has positions in Airbnb. The Motley Fool has positions in and recommends Airbnb and Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.