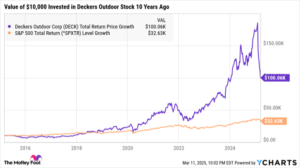

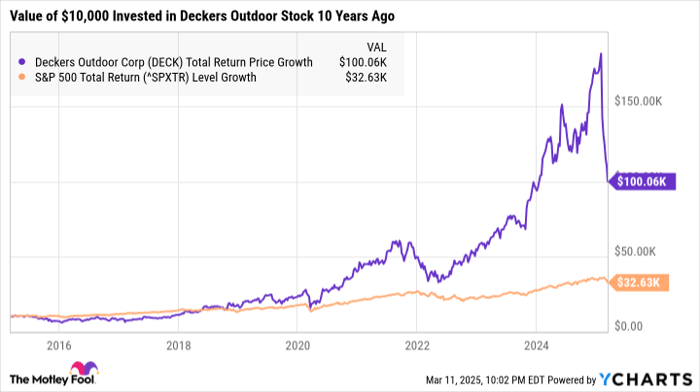

If You’d Invested $10,000 in Deckers Outdoor Stock 10 Years Ago, Here’s How Much You’d Have Today

Deckers Outdoor (NYSE: DECK) is recognized for its footwear brands, including the iconic UGG sheepskin boots that have been widely popular since the early 2000s.

Perhaps its biggest success story is from the Hoka brand of high-performance running and athletic shoes, which it reportedly acquired for just $1.1 million back in 2012. Over the past decade, Hoka has managed to cross over into the lifestyle category, evolving into a fashion phenomenon with blistering global demand. The brand alone is on track to generate more than $2 billion in sales this year.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Longtime shareholders can take a victory lap. A $10,000 investment in Deckers Outdoor stock 10 years ago would be worth $100,060 today, a cool 901% return, and nearly three times the gain in the S&P 500 over the period.

DECK Total Return Price data by YCharts

Mixed trends into 2025

Despite a record year for revenue and earnings, Deckers Outdoor shares have been extremely volatile since the start of 2025, down about 40% year to date.

Following a better-than-expected fiscal third-quarter report covering the holiday shopping season through Dec. 31, where total revenue climbed by 17% year over year, the market appears concerned that growth and profitability margins may have peaked and will decelerate from the exceptional high levels in recent quarters.

Nevertheless, company fundamentals remain solid, with an outlook for continued growth.

What’s next for Deckers Outdoor stock?

The silver lining to the recent sell-off in shares of Deckers Outdoor is that it has worked to reset its once-lofty valuation to a more palatable level.

The stock is currently trading at a forward price-to-earnings (P/E) ratio of 21 relative to the company’s full-year earnings per share guidance between $5.75 and $5.80. This level could prove to be a bargain, particularly if the company manages to exceed expectations as it moves forward with its global expansion. While another multibagger return from Deckers is unlikely anytime soon, the company remains well-positioned to reward shareholders over the long run.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $299,728!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $39,754!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $480,061!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of March 14, 2025

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Deckers Outdoor. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.