Nvidia Sold All of Its SoundHound AI Stock. Should Investors Follow This AI Leader?

One of the original catalysts for why SoundHound AI (NASDAQ: SOUN) went on a massive run was that it was revealed that Nvidia invested in it. This automatically gave SoundHound credibility as to its position in the artificial intelligence (AI) arms race. However, that is no longer the case.

In its latest 13F filing (which reveals what investments a company holds if it has more than $100 million invested across its portfolio), the public became aware that Nvidia sold all of its SoundHound AI stake and trimmed some others. This caused SoundHound’s stock to sell off, as many investors assume that Nvidia knows something we don’t.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

So, is this true? Or could this be a massive buying opportunity?

SoundHound wasn’t a huge part of Nvidia’s investment portfolio

One thing to remember is how large Nvidia’s stake in SoundHound was. Nvidia owned 1.7 million shares, valued at $33.7 million on Dec. 31, 2024 (the last day Nvidia could have sold its shares for this 13F filing). While that may seem like a massive chunk of money to you and me, it’s pocket change for Nvidia.

Last quarter, Nvidia produced $16.8 billion in free cash flow and had $38.5 billion in cash and short-term investments on its balance sheet. So this decision to sell SoundHound stock may not have been for business purposes; it could have just been to clean out some shares it was holding from companies it did deals with.

I think this is more noise than signal for SoundHound AI investors, but with the audio stock down 45% in 2025 alone, it’s worth considering whether it’s worth buying on sale.

SoundHound is still primed for massive growth in 2025

SoundHound AI makes audio recognition software for AI models, which has massive potential. The company’s results back this up, as its revenue rose 89% in Q3. Observers will get an update on Q4 results and official 2025 guidance on Feb. 27, but management has already clued investors in on how strong 2025 will be.

During its Q3 conference call, SoundHound’s management team gave preliminary 2025 guidance that stated its revenue should be between $155 million and $175 million. Considering that 2024’s total is projected to be between $82 million and $85 million, this indicates that revenue will double in 2025. Investors should be excited about that, but it comes at a steep price.

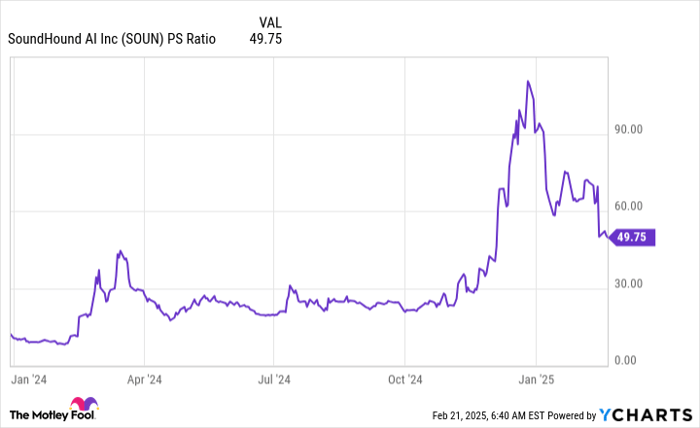

Even after its massive sell-off, SoundHound’s stock is far from cheap. Because the company doesn’t have any profits, potential investors need to value SoundHound using its sales. SoundHound currently trades at 50 times sales, which is far cheaper than where it was trading, but still more expensive than where it spent most of 2024.

SOUN PS Ratio data by YCharts

Indeed, 50 times sales is a very expensive stock price, but it’s more justifiable considering SoundHound should double its revenue next year. However, I’m not sure if this is a buying point.

SoundHound still has a premium valuation, and the selling pressure on the stock is incredibly high as investors consider moving on from one of last year’s best performers. Unless SoundHound’s Q4 results greatly exceed expectations, I wouldn’t be surprised to see the stock sell off after Q4 earnings. After that report, I may consider SoundHound AI again, as the hype will have been sold off from the stock, and what remains is an actual business.

Despite the huge sell-off, investors must be patient with SoundHound, as it could have further to go if its Q4 results aren’t perfect. If you’re sitting on huge gains from the stock, I also think it may be prudent to take a bit of your gains, as you’re likely sitting on a significant profit if you’ve owned the stock for at least a year.

There are still plenty of questions surrounding SoundHound AI, but investors need to be a bit more patient before diving in.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $337,818!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,848!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $533,073!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 24, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.