Think You Know Roku? Here’s 1 Little-Known Fact You Can’t Overlook.

You know Roku (NASDAQ: ROKU) as a leading provider of media-streaming software and devices in North America. It has been the top seller of smart TV operating systems in the U.S. for the past five years, and also leads the pack in Canada and Mexico.

Roku’s domestic dominance is so robust that the company doesn’t even report international business results yet. But that’s about to change.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

You see, Roku’s overseas business is making a significant impact on the company’s overall financials. Roku is an increasingly international growth story. If you’re thinking about investing in Roku, or already have a few shares under your belt, you should keep a close eye on its international expansion plans.

Image source: Getty Images.

A measured march onto the world stage

Roku is approaching its foreign market expansion in a targeted manner.

Unsurprisingly, its strategy looks a lot like the early days of Netflix (NASDAQ: NFLX) setting up streaming services abroad. Roku’s former parent company started with domestic and Canadian streaming services, followed by a broad expansion across South America and a couple of key territories in western Europe. After that, Netflix surprised everyone with a worldwide coverage explosion in January 2016, four and a half years after separating its old DVD-by-mail service from the streaming business.

Roku is moving a bit slower. It has been selling Roku-branded media players and smart TVs in markets like France and Australia since 2015, adding handfuls of new territories over time. In 2025, the company offers streaming platforms and access to the ad-supported Roku Channel across the Americas, Australia, and four European countries.

Again, Roku isn’t reporting financial results from these international target markets, but they are starting to change several core metrics of this business.

How Roku’s overseas growth affects its financial results

Let’s take a look at Roku’s third-quarter 2024 numbers. The company will release fourth-quarter and full-year numbers on Thursday evening, most likely continuing the business trends seen in recent reports.

Roku reported 85.5 million streaming households in the third quarter, a 13% year-over-year increase. The volume of streaming hours recorded on Roku-powered devices rose by 20% over the same span, suggesting more media engagement per user.

But platform revenues only increased by 15%, because the average revenue per user (ARPU) held steady at $41.10 per month. Why? Because Roku is growing its international user base faster than the domestic portion these days, and the expansion effort includes a fair amount of pricing discounts in the targeted expansion markets.

On the third-quarterearnings call CEO and founder Anthony Wood explained how the foreign growth is working out.

“It’s basically all of the Americas plus the U.K. and we’re making good progress in all those countries on active account or streaming household growth,” he said. “Those countries are in different stages of monetization, but they’re all fairly early in monetization.”

Roku is pulling the usual range of price-control levers to promote faster user growth in key expansion markets. It kind of hurts Roku’s bottom line, but also builds a robust platform for long-term business growth. Price increases and generous profits can wait until the expansion push has established a large and healthy revenue stream.

Following in Netflix’s winning footsteps

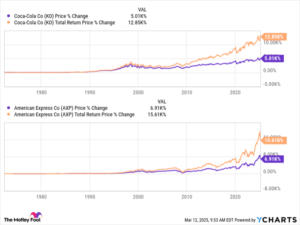

Netflix walked a similar path on the way to its current media-empire status. It wasn’t a smooth ride and Netflix recorded several years of negative free cash flows along the way, but you can’t argue with the results. Netflix investors have enjoyed a 570% return over the last decade, nearly tripling the S&P 500 market index’s growth.

So Roku is following in the footsteps of a fantastic role model. I can’t guarantee that the long-term outcome will be as impressive as Netflix’s, and there are some significant differences in the speed of each timeline. Still, Roku follows a proven playbook here. I expect its international growth to continue, eventually forcing management to report those non-U.S. financials on a quarterly basis.

The overseas business is already changing Roku’s financial results and growing too important to ignore.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $344,352!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,103!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $543,649!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of February 3, 2025

Anders Bylund has positions in Netflix and Roku. The Motley Fool has positions in and recommends Netflix and Roku. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.