Memories can become short when markets get turbulent. Palantir Technologies (NASDAQ: PLTR) was at an all-time high less than a month ago, but has quickly tumbled approximately 30% since its peak as the broader Nasdaq Composite has entered a correction. But if you zoom out, the stock is up about 1,000% over the past two years, even with the recent decline.

That’s seriously impressive. The S&P 500 (SNPINDEX: ^GSPC) historically returns an average of roughly 10% annually — some years much more; some years much less, even a loss. Wall Street’s excitement for artificial intelligence (AI) and Palantir’s accelerating growth, emerging leadership in AI software, and long-term potential have fueled the stock’s ascension.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

When stock prices rocket higher like this, you sometimes get stock splits, which increase the number of shares while decreasing the price proportionally. Individual investors generally love stock splits because they lower the share price, making it easier to buy shares for those without access to fractional shares. Remember, stock splits do this by increasing the share count, so the stock isn’t fundamentally cheaper. The share price is lower because each share represents less equity in the company.

So, should investors expect Palantir to split its stock anytime soon? Here are two key things to consider.

1. Palantir’s stock price isn’t exorbitantly high

Arguably, the primary benefit of stock splits is that they make stocks easier to buy or sell and remove an emotional barrier for folks looking only at share price rather than value. For individual investors, it can be easier to accumulate shares when you can buy them at lower prices. (Don’t forget some brokerages offer fractional shares for those who don’t have enough investing cash for a full share.) For company employees sitting on stock-based compensation, having more shares at a lower price makes it easier to control how much they cash out at any given time.

While Palantir stock has done tremendously well over the past couple of years, it closed Tuesday at $78, so there’s no real sticker shock there.

2. Share price momentum has turned lower

There’s an additional argument that Palantir’s recent price momentum is working against a split happening. Long-term investors shouldn’t put too much emphasis on near-term share prices, but price momentum does impact sentiment toward a company. A stock split sends a message to investors.

It might be seen as a positive when a company’s stock is red hot. It says: Hey, things are going great, and we want to make shares more affordable, so more investors can participate in our success. On the other hand, a split while the stock is struggling could send a negative message. People don’t like seeing low share prices, so splitting when the stock is dropping isn’t as likely.

Palantir is currently on a slide; shares have fallen over 30% over the past several weeks, so I think that argues against an impending stock split.

Nobody can predict short-term share prices, so Palantir’s slide could end soon, but it could also continue, especially if investors balk more at its high valuation.

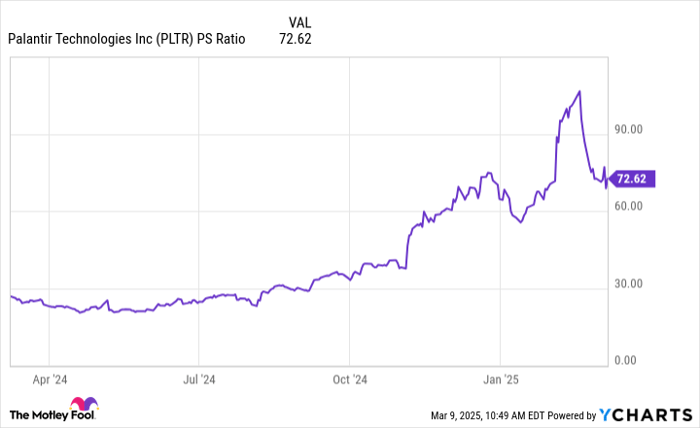

Check out its price-to-sales ratio in the chart below.

PLTR PS Ratio data by YCharts

Even the great Nvidia, arguably the most successful AI stock over these past two years, peaked at a price-to-sales ratio of 45, and that makes Palantir look even more expensive. Palantir’s share price could drop 50% if its valuation reverts closer to other AI stocks.

Should investors expect a stock split?

Remember, stock splits don’t fundamentally change anything about a stock other than its share price, so investors should never buy or sell a stock based on the prospects of a stock split.

That said, stock splits are most likely when a stock has momentum, growth expectations, and a share price that has become seemingly burdensome to investors. Palantir doesn’t check all those boxes today.

The stock has been a huge winner, and Palantir’s business is poised to grow for the foreseeable future. Yet the stock’s aggressive valuation already reflected much of that. Now that it’s begun unwinding, it’s hard to see management deciding to split the stock.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $666,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 10, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.