This Could Be a Huge Blow to Hims & Hers Health Stock

Hims & Hers Health (NYSE: HIMS) has been a top healthcare stock to own over the past five years, soaring by around 350% during that stretch. By focusing on offering customers personalized telehealth options, the business has experienced tremendous growth.

A big opportunity lately has been in helping people access GLP-1 weight loss drugs, which can sometimes be difficult to get because of huge demand. But that strategy could face some challenges ahead as Hims & Hers doesn’t make top GLP-1 drugs. Instead, it has been able to connect patients to compounded drugs that aren’t approved by regulators and involve a mixture of multiple ingredients.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

While they aren’t exact copies of popular GLP-1 drugs, they are permissible to make — but that’s only amid a shortage. And recently, the Food and Drug Administration announced that semaglutide, the active ingredient in Ozempic and Wegovy (which Novo Nordisk makes), is no longer in shortage. That could undermine Hims & Hers’ growth strategy.

A slowing growth rate could hurt Hims’ stock

In the past few years, Hims & Hers has made for a captivating growth stock as its business has been booming. Sales in the past year hit just under $1.5 billion, which is nearly three times the $527 million it reported back in 2022. The company focuses on providing patients with personalized medications, including treating sensitive areas such as erectile dysfunction and hair loss. And by expanding its offerings, it has reached a broader group of customers.

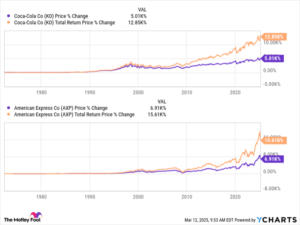

HIMS Operating Revenue (Quarterly YoY Growth) data by YCharts

Its fantastic growth in recent years has been a big reason for the stock’s success, and there’s been a notable acceleration of late as it has focused on weight loss. But with a market capitalization at $10 billion and the stock trading at 85 times its trailing earnings, the pressure is on for Hims & Hers to continue generating strong growth in the future, or the premium that investors are paying for the business may no longer be justifiable.

How can Hims & Hers adjust if semaglutide is no longer in shortage?

Hims & Hers stock fell on the news that semaglutide was no longer in shortage, but CFO Yemi Okupe doesn’t appear to be overly concerned about the developments. The company is going to focus on oral medications and selling a generic version of liraglutide, which Novo Nordisk also makes. And Okupe still believes that even without semaglutide, the company’s weight loss business may generate $725 million in revenue this year.

Patients, however, may not be keen on switching from semaglutide to other treatment options, especially if they have become accustomed to it and aren’t experiencing problematic side effects, which can sometimes be the biggest issue with staying on GLP-1 treatments.

Plus, semaglutide is in high demand because of its effectiveness and ability for people to lose around 15% of their body weight, on average. With liraglutide, the average weight loss has been around 5% to 10%.

And if semaglutide is more easily accessible now so that it is no longer in short supply, it may lead to a decline in demand for Hims & Hers’ personalized medications. The big question is how willing patients will be to switch to a different weight loss product. Management appears confident that won’t be a big issue, but if demand doesn’t remain robust, Hims & Hers’ growth rate could slow significantly.

Is Hims & Hers Health stock still a good buy?

Hims & Hers has been generating a lot of growth in recent years but my concern is that with weight loss being a big part of its strategy moving forward, its growth rate may once again slow down in future quarters. And the stock’s massive gains in recent years mean it’ll be more difficult to justify investing in the business at such an inflated valuation if expectations aren’t high that its profits will increase significantly in the future.

Investors may want to take a wait-and-see approach with the healthcare stock to see how strong its results are in the next few quarters and to gain a glimpse into whether demand remains strong even after switching patients onto other weight loss treatments, before deciding to invest in it. If there isn’t a big drop-off in demand, that could be a sign that its strategy is sound. But it’s too early to tell if that will prove to be the case, which is why I’d hold off on buying the stock for now.

Should you invest $1,000 in Hims & Hers Health right now?

Before you buy stock in Hims & Hers Health, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hims & Hers Health wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

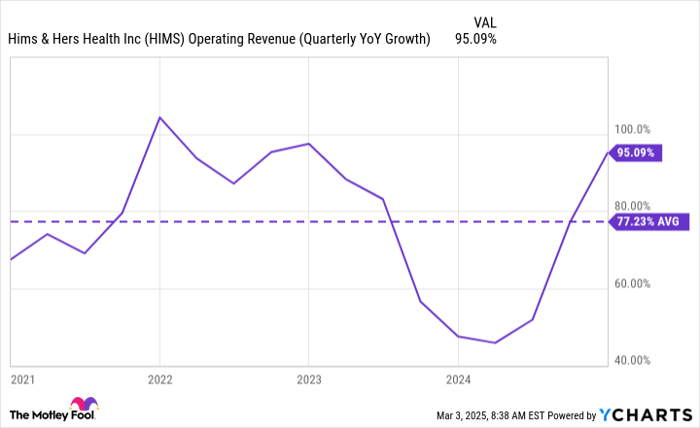

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $718,876!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.