Uncertainty Abounds, but Recession Fears Premature

Rising uncertainty contributes to S&P 500 and Nasdaq-100 falling into correction

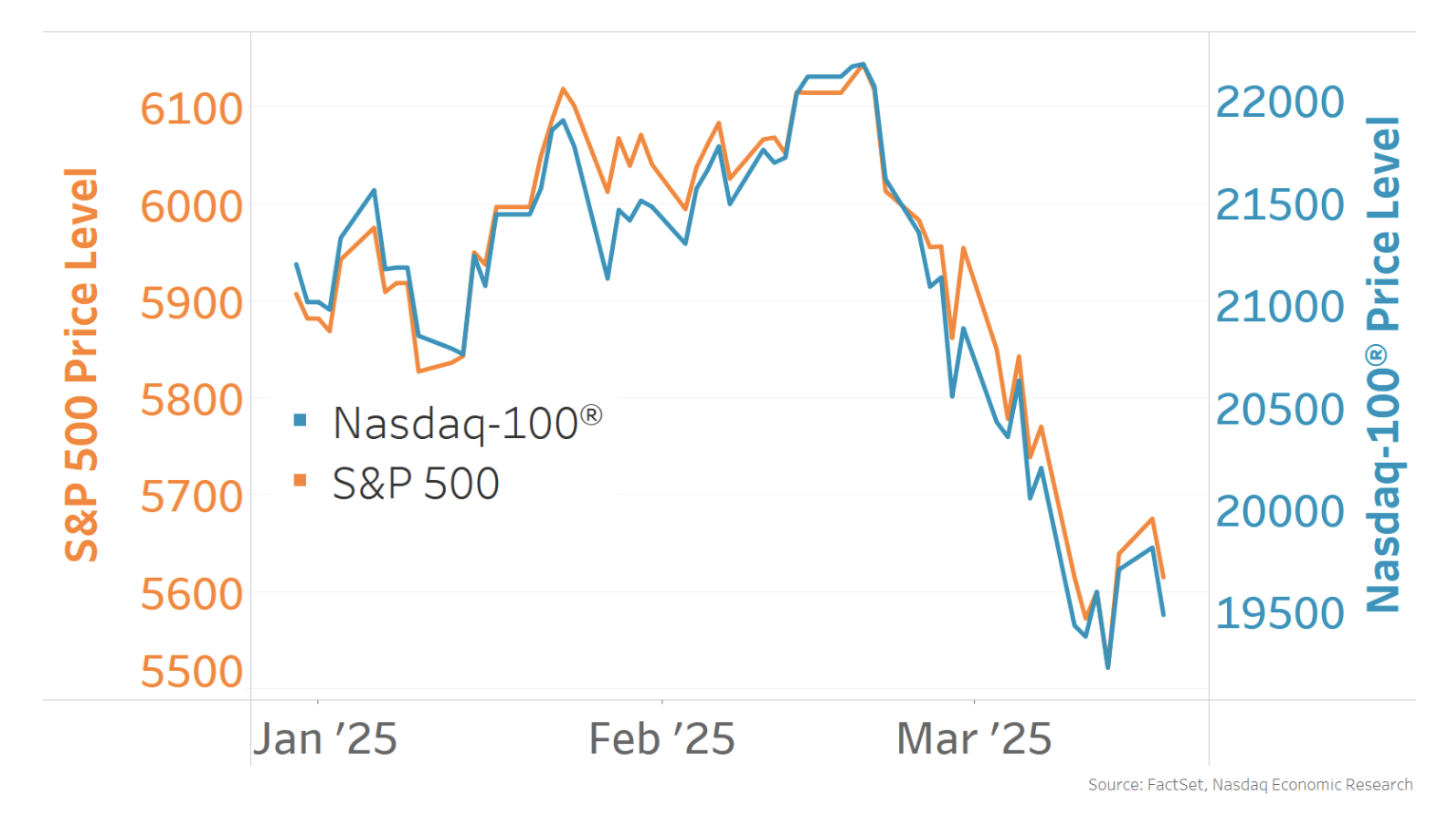

It’s been a tough few weeks for stocks, with the S&P 500 and the Nasdaq-100 (chart below, blue line) both falling into correction recently (down at least 10% from their peaks).

There have been multiple factors contributing to this selloff:

But a lot of it comes down to increased policy uncertainty.

The last couple months have seen rapid and significant policy changes from the Trump administration. This is especially true for tariffs, which have seen some policies implemented, some delayed, some reversed, and others just being studied.

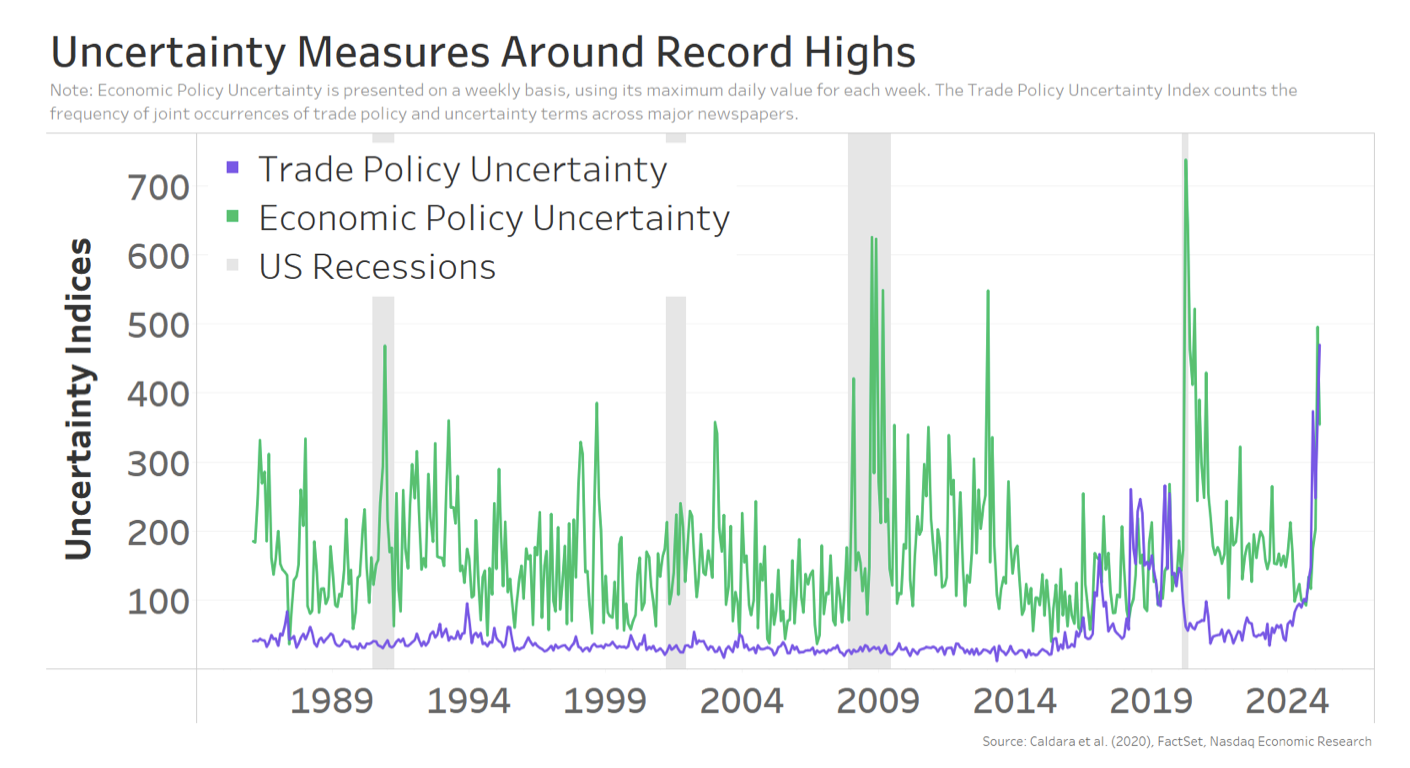

In response to these changes, the Trade Policy Uncertainty Index reached a record high in February (chart below, purple line), while the broader Economic Policy Uncertainty Index is up to levels last seen during Covid and the Global Financial Crisis (green line)… and 2012’s (non-recessionary) “fiscal cliff” episode.

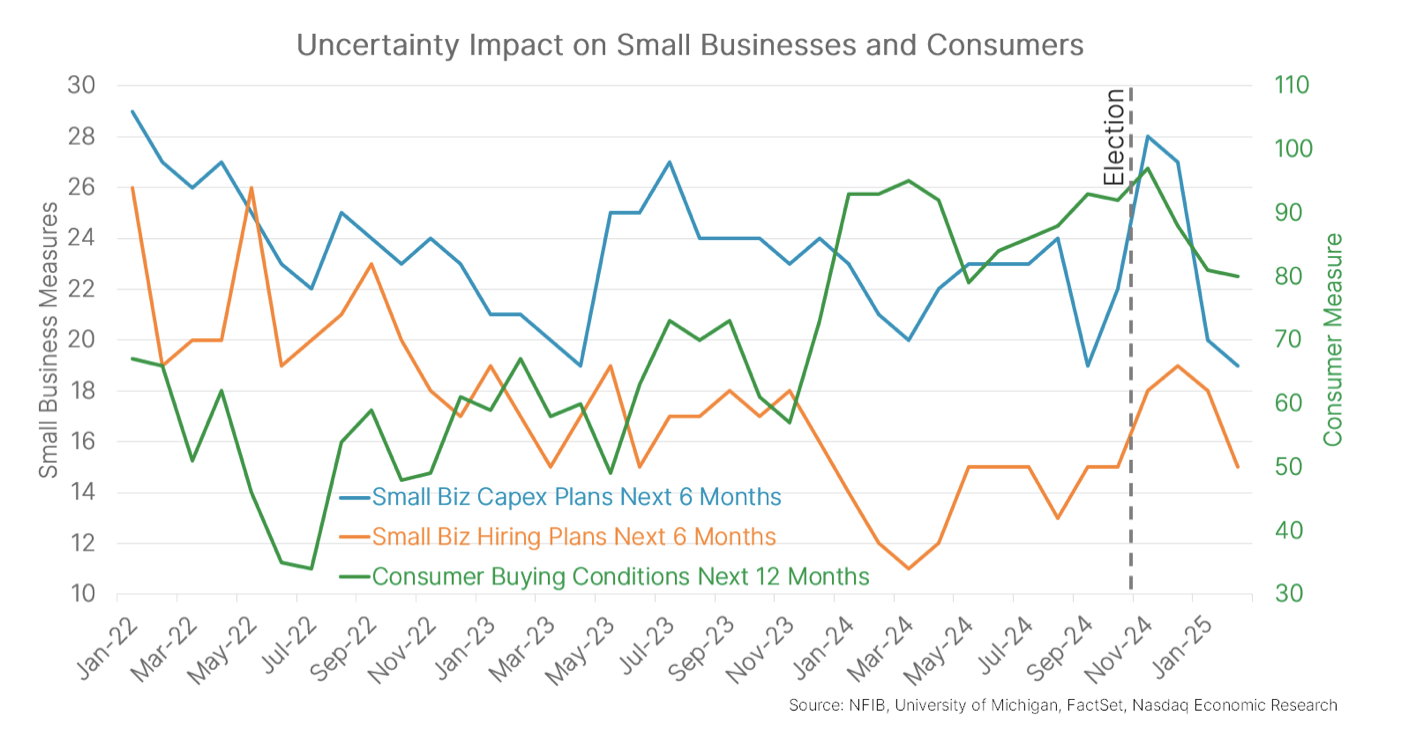

Surveys show consumers and small businesses pulling back in response to increased uncertainty

The problem with increased policy uncertainty is that it makes it harder for businesses and consumers to make decisions, so they delay investment and spending while they wait for more clarity.

This is exactly what we’re seeing in recent surveys of small business and consumers.

For businesses, this means reducing hiring plans (chart below, orange line) and slowing capex spending (blue line) – or investment in equipment, factories, etc.

And consumers are saying that prospects for making a big-ticket purchase (homes, cars, appliances, etc) are getting worse (green line).

Uncertainty could lead to slower growth this year, but recession talk is premature

So, if increased uncertainty means small businesses and consumers pull back on spending and investment, it will be a drag on growth. In fact, Goldman Sachs and the OECD both cited uncertainty when they recently revised down their US growth projections for 2025 to 1.7% and 2.2%, respectively.

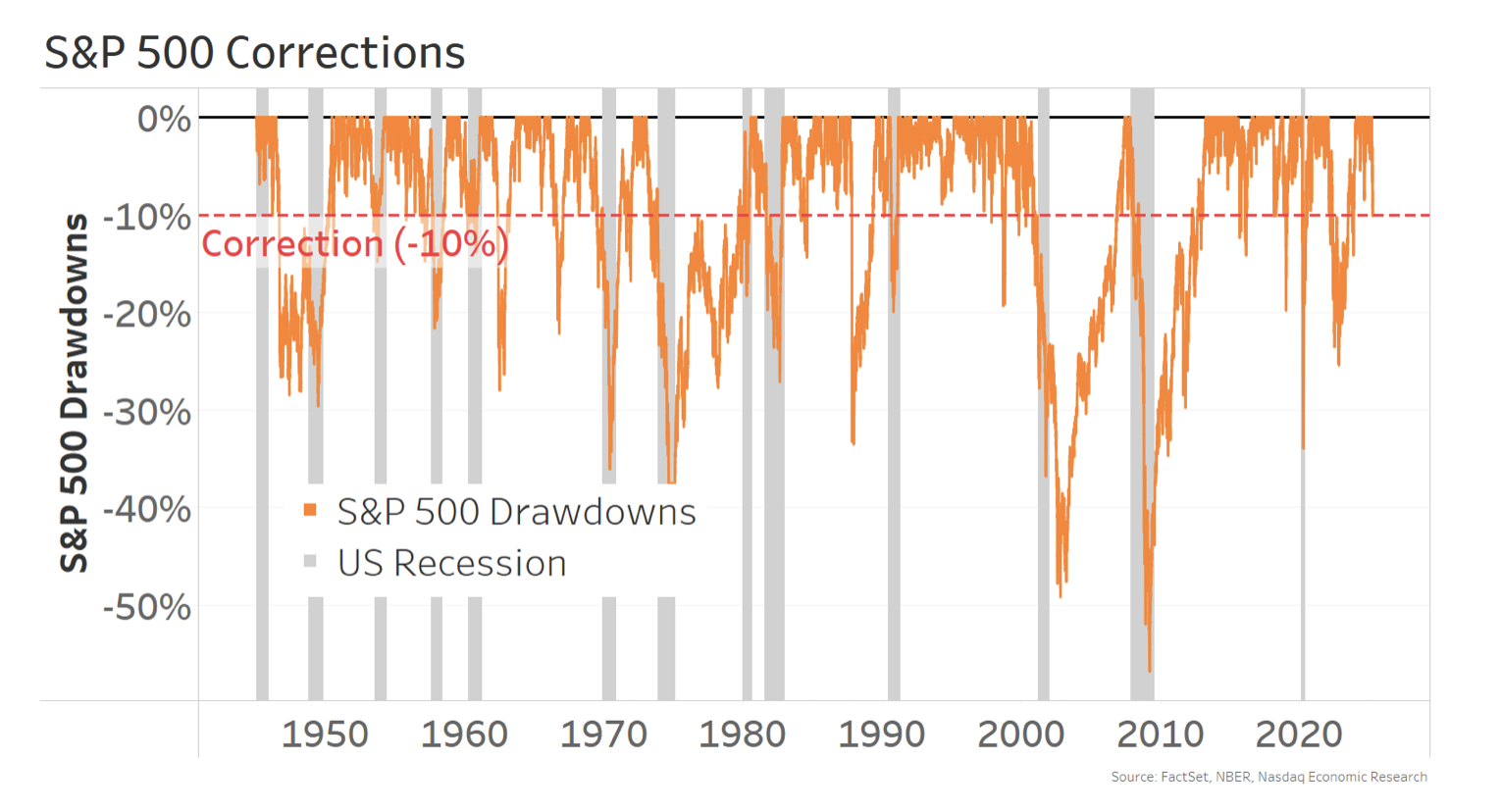

But ~2% real GDP growth is far from recessionary. And yet, if you’re just reading the news (or watching the stock market), you’d be forgiven for (mistakenly) thinking the US economy is on the brink of recession. However, market corrections (chart below, red line) happen routinely outside recessions (gray shaded areas).

So, while it’d be best for the economy for businesses and consumers to get the clarity they’re looking for, it’s important to remember that the economy ended 2024 on solid footing, which gives it some ability to absorb negative shocks. And the little hard data we’ve gotten for February (when tariffs first took effect) isn’t too concerning (yet) – the economy added a solid 151,000 jobs and “core” retail sales (ex. gas, autos, and building materials) rose 1% from January.

For now, before worrying about recession, it’s worth waiting for some more (hard) data.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2025. Nasdaq, Inc. All Rights Reserved.